Updated Graph of Buffett Indicator (4th quarter, 2024)

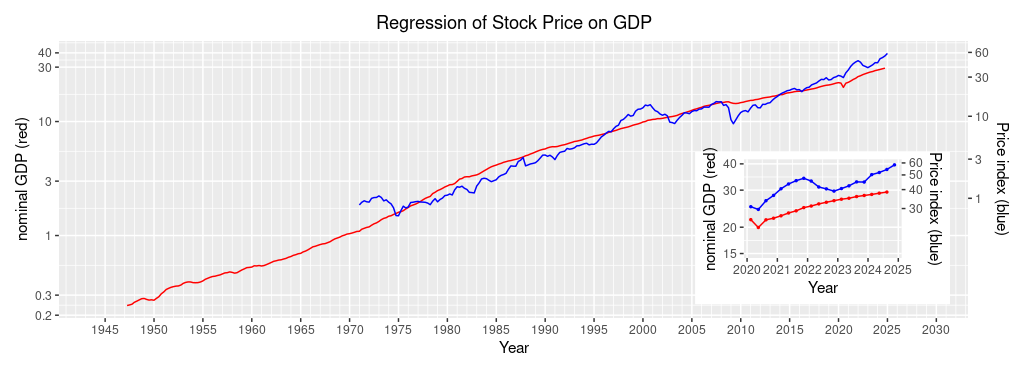

This page presents the updated graph of the Buffett Indicator for the US stock markets. The Buffett Indicator (the right-most column) has steadily increased since the 4th quarter of 2022. The index was 1.156, then. However, the index does not reach the previous peak in the 3rd quarter of 2021. The index was 1.582, then. This year, because the Wilshire 5000 Price Index rose by 7.2% in the 4th quarter, the index will likely increase from 1.410 in the 3rd quarter to over 1.5. The presidential election was held in the 4th quarter, and Trump came back to the White House. Some industries, such as Fintech, are receiving spotlights. See How the US stock markets will move in 2025.

| Year | Quarter | Nominal GDP (red, left scale) | Wilshire 5000 Price Index Quarterly mean (blue, right scale) | Wilshire 5000 Price Index Fitted value (red, right scale) | Wilshire 5000 Price Index Quarterly mean / Fitted value |

| 2021 | 1st | 22,657 | 40,525 | 26,866 | 1.508 |

| 2nd | 23,369 | 43,581 | 28,047 | 1.554 | |

| 3rd | 23,922 | 45,026 | 28,973 | 1.582 | |

| 4th | 24,777 | 47,519 | 30,421 | 1.562 | |

| 2022 | 1st | 25,215 | 45,565 | 31,172 | 1.462 |

| 2nd | 25,806 | 41,627 | 32,191 | 1.293 | |

| 3rd | 26,272 | 40,448 | 33,002 | 1.227 | |

| 4th | 27,34 | 39,099 | 33,811 | 1.156 | |

| 2023 | 1st | 27,164 | 40,640 | 34,569 | 1.176 |

| 2nd | 27,454 | 42,370 | 35,082 | 1.208 | |

| 3rd | 27,968 | 44,978 | 35,997 | 1.249 | |

| 4th | 28,297 | 44,870 | 36,588 | 1.226 | |

| 2024 | 1st | 28,624 | 50,233 | 37,177 | 1.351 |

| 2nd | 29,017 | 51,877 | 37,887 | 1.369 | |

| 3rd | 29,735 | 54,340 | 38,538 | 1.410 | |

| 4th | N/A | 58,277 | N/A | N/A |